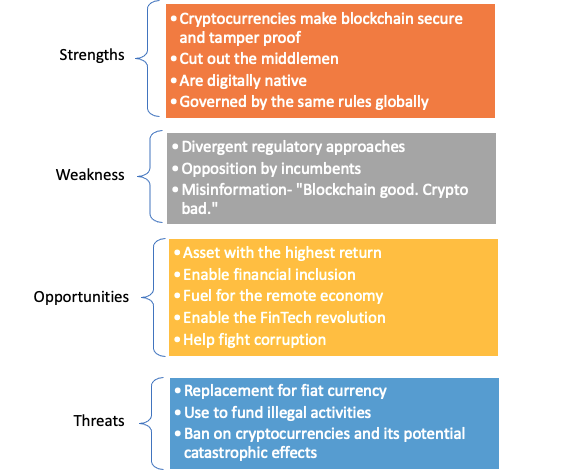

This blogpost explains why cryptocurrencies and blockchain are the next big thing in the global technology revolution, and why India must become a part of this revolution. This is especially important in light of the proposed ban on cryptocurrency in India, which could exclude India from the exciting developments taking place around blockchain and cryptocurrency. This blogpost includes arguments explaining the strengths, weaknesses, opportunities and threats, or a SWOT analysis of cryptocurrencies. Importantly, it discusses how these threats can be addressed.

INTRODUCTION

Cryptocurrencies are nothing but a technology to store information on a blockchain. Think of blockchain as an electronic ledger, and cryptocurrency as the ink used to record entries on it.

What is special about this technology? It is tamper-proof and does not need a third-party recordkeeper, cutting out intermediaries.

Different cryptocurrencies store different kinds of information and hence have different use cases. It can be a store of financial information or a land record or your health data. When used for financial information, it can be used to remit money used by Indian workers in the Middle East to remit money to their families in Kerala. By cutting out the money exchangers, remitters and hawala channels, this remittance can be done faster and at a fraction of the cost. When used to store land records, they ensure that the records cannot be tampered with, reducing corruption and fraud.

Influential technologists, the International Monetary Fund, and many others believe that blockchain is a foundational technology as promising as the internet itself. We argue that cryptocurrencies are the equivalent of the many applications of the internet. So just like Gmail, Whatsapp, Netflix, Uber are applications of the internet; the 1500 cryptocurrencies that exist today are various applications of the blockchain.

The World’s largest financial institutions –JP Morgan Chase, Morgan Stanley and Goldman Sachs – have adopted cryptocurrencies for fund transfers, blockchain based investment products and to oversee digital assets. No asset class has created as much wealth in a ten year period, including during the pandemic. Bitcoin was at USD 0 in 2010 and is hovering at USD 45,000 in 2022. If Bitcoin reached USD 200,000, half of the World’s billionaires would have made their wealth in cryptocurrencies. India cannot afford to lose this wealth-creation opportunity.

Further, with the deep talent pool in software in India, an entire generation of crypto-entrepreneurs have been birthed here. India was late to the dot com party, but now is optimally placed to seize the opportunity to create new business, wealth, and jobs. This opportunity should not be denied to our entrepreneurs.

But cryptocurrencies bring risks too. These include losses arising out of hacking, loss of password, compromise of access credentials, malware attack etc., lack of grievance redressal mechanism for users; volatility in price and their use in illegal and illicit activities. But, like every pioneering technology, the risks associated with cryptocurrency, rather than its potential, are the point of focus for naysayers and incumbents – and these risks can be mitigated and managed with appropriate regulation, standard setting and advancement in technology.

With pioneering regulation, India can grab what is likely to be the biggest economic opportunity of the decade. Our progressive neighbours such as Singapore and Dubai, and allies such as the Unites States and Germany have already cashed in on this opportunity with regulation. On the other hand, the only countries that have banned cryptocurrencies are China, Russia, Venezuela, and Bangladesh, countries that do not share the same constitutional values as us.

Should India wait and watch?

Will any of these risks prevent cryptocurrencies taking their place alongside other more conventional global currencies? Should those in charge of safeguarding the integrity our financial systems be concerned?

There are valid concerns. However, technology-driven advances don’t always hang around for governments to make up their minds about them. Recognising this progressive regulators around the world have attempted to develop common global standards aimed at mitigating the risks associated with cryptocurrencies. A good example is are the recommendations made by the Financial Action Task Force (“FATF”). The FATF in June 2015 recommended regulation of entities which provide gateways to the regulated financial system. It has further warned that an outright that an outright ban on cryptocurrencies would not be effective in curbing their misuse. All such a ban will achieve is to drive cryptocurrencies underground. The current Managing Director of the International Monetary Fund- Christine Laggard, has gone as far as to say that cryptocurrencies have as much of a future as the internet itself.

These efforts to achieve common global standards for a technology of the future (one that is inherently global in nature) will be significantly hampered by divergent local approaches. India should not come in the way. It should lead the way.

A SWOT analysis for cryptocurrency

In this report we have undertaken a SWOT analysis for cryptocurrency – what are the strengths and weaknesses of this technology; what are the opportunities and threat they present for India. With this analysis, we will show that the inherent strengths of and opportunities presented by cryptocurrencies are too large to be ignored, while the weaknesses and threats can be managed by regulatory approaches already being adopted by various countries.

An idea whose time has come

In closing, we are reminded of the “red flags” law in the United States of 1894, that required every automobile to be accompanied by an adult with a red flag walking ahead of the automobile to warn those on its way. Yes, automobiles imposed risks (of life and limb, in this case) and they continue to do so a 125 years later but we have capitalised on the opportunity while managing these risks through regulation (requirement of license), imposition of standards (for safety and testing) and technology (seat belts and air bags). Just like automobiles brought the world closer, cryptocurrencies will do the same by breaking down artificial borders implemented for exchange of value. It is an idea whose time has come, and India may already be a little late.

SWOT analysis of cryptocurrencies

STRENGTHS

Cryptocurrencies make blockchain secure and tamper proof

If a blockchain is maintained by a single authority or at a single location, then it is subject to as many short-coming as traditional ledger. It has a central point of attack and failure. That means that if the ledger itself is lost, destroyed or altered, all records are lost. It can be tampered with and hence vulnerable to fraud.

However, when a blockchain is

- distributed (i.e., it is not maintained at any one particular location but is distributed amongst all users (a.k.a. “nodes”) of the particular blockchain),

- decentralized (i.e., a new block may be added to the blockchain only if all nodes of the blockchain validate such addition), and

- public ledger (i.e., it is freely available to the public at large who may view all entries on a blockchain),

then it becomes immutable. Use of security measures like hash-functions and public-private key encryption to execute transactions adds another layer of security. Because of such measure’s transactions on such blockchains cannot be reversed or altered.

Cut out the middlemen

Nearly all fiat currency transactions require a trusted middleman to oversee the transaction. This middleman could be a bank, a money exchanger or a card network. This makes the process longer and expensive – after all the middlemen will take their time and commission. Transactions on a public blockchain do not require a middleman to establish trust, because of its immutability. As such transaction on blockchain are cheaper and faster.

To get an idea of how financial intermediaries increase the costs of financial services consider the following- in 2018 India received over USD 83 billion in inward remittances. The estimated cost of these was USD 4.1 billion. Remittance through cryptocurrencies would have cut this cost by 60% translating to saving of INR 18,000 crore per year.

Digitally Native

A cryptocurrency is native to the blockchain it works on. It does not have a ‘hard-copy’ counterpart in the real world. This is essential to make blockchain work. Cryptocurrencies are the means through which each node of a blockchain is rewarded for its service rendered toward maintaining the blockchain. The scale at which such global blockchains operate, they require millions of micro-payments across the globe in real-time which is impossible to support with fiat currency that is not digitally native.

Another benefit of this is that any improvement in the code underlying blockchain will almost automatically reflected on the attached cryptocurrency. This makes cryptocurrencies highly adaptable.

Contrast this with fiat currency. Money stored digitally is actually a digital representation of a real-world currency. As such all technology that manages digital money does is to actually track and corelate its real-world use. It is not a part of the underlying technology. Which makes the technology less adaptable to change.

Governed by the same rules globally

Cryptocurrency can be used and traded across all jurisdictions which have free access to the internet. This makes them ideal for high volume multi-jurisdiction transactions. With the right set of regulations India can leverage this capability to its advantage. It will allow India based entrepreneurs and business to export their goods and services across the world with minimal bureaucratic hindrances.

WEAKNESS

Divergent regulatory approaches

Different countries have adopted different regulatory standards for cryptocurrencies. Most progressive democracies have recognised the potential of cryptocurrencies and chosen to regulate, rather than ban or prohibit their trade. However, other countries like Algeria, Bolivia, Saudi Arabia, Venezuela and Bangladesh have gone the other way and chosen to ban the trade of cryptocurrencies. China has severely restricted the use of cryptocurrencies but not imposed a complete ban. Indonesia banned cryptocurrencies but has since liberalised the sector. Several jurisdictions are mulling over the best method to deal with cryptocurrency. These regulatory uncertainties add an unnecessary roadblock in an otherwise smooth global flow of cryptocurrencies.

Opposition by incumbents

Cryptocurrencies would disrupt traditional players including traditional financial service providers such as banks, insurance and exchanges[1]. As such cryptocurrencies have caused discomfort to incumbents. The more progressive players, realising the inevitability of technological progression, are slowly choosing to adopt cryptocurrencies for their traditional offering[2]. However, the traditionalists continue to have misgivings[3].

Misinformation- “Blockchain good. Crypto Bad”

The government of India has reiterated time and again that blockchain technology is good. The government also welcomes blockchain based solution in its various pioneering programs such as the National Digital Health Mission[4]and the RBI regulatory sandbox. However, nearly all innovative blockchain solutions require cryptocurrencies to function. In fact, the interdependence between a blockchain and its cryptocurrency is so much that they are often used as synonyms for each other. For e.g. the term “bitcoin” refers not just to cryptocurrency but also the blockchain which records the bitcoin transactions[5].

OPPORTUNITIES

Asset with the highest return – the largest wealth creation opportunity we have seen in a lifetime

Cryptocurrencies first appeared on the scene in 2010 and since the crypto-industry has grown to become a one trillion dollar behemoth[6]. Cryptocurrencies have created more wealth in the past decade than some prominent unicorn start-ups around the world combined[7]. Tech gurus see cryptocurrencies as the bedrock of future tech-development. As such many tech commentators have even gone so far as to say that a ban on cryptocurrencies would be equivalent to ban on the internet in the 1990’s[8].

Prominent investors world over see enormous potential in the crypto industry and continue to pour billions of dollars to fund crypto start-ups. With the right policy India is can capitalise on this opportunity and be the safe haven for crypto investments.

Financial inclusion

Any person who has access to internet and a smart device can have access to – cryptocurrencies, the underlying blockchain technology and all the benefits that go along with these including access to financial services. As per World Bank estimates nearly 64% in developing countries don’t have access to banking system and basic financial services[9]. However, it is estimated that nearly 70 % of the world will have access to a smart phone device[10]. Thus, large swathes of our population who would not have access to the banking system can be granted access to financial services through cryptocurrencies.

Can fuel the remote economy

As a leader of business process outsourcing industry offering remote services has always been India’s forte. The Covid-19 pandemic has further shown how far remote working can be stretched. Indians sitting in India are capable of rendering services in any part of the world. The essential element in this process is the ability for Indian worker to receive remittances in a reliable, cheap and timely manner. Cryptocurrencies offers all these solutions. They work across borders and without middlemen. As such cryptocurrency remittances tend to be a fraction of the cost of traditional money transfer options, and quicker as well.

FinTech Revolution

There is a crypto enabled technological equivalent of all financial services offered traditional financial firms such as – banking, insurance, payments, asset management etc. Crypto enabled fintech solution are more efficient, transparent and less bureaucratic[11]. By facilitating rather than banning cryptocurrencies, India can seize the opportunity to be the next financial hub of the world, shifting the world’s financial base from Wall Street to Dalal Street.

Fight corruption

Through a combination of smart contracts and cryptocurrencies, citizens and the State keep a tab on how State funds are spent[12].

Revenue for the exchequer

Cryptocurrency transactions can contribute enormously to tax revenue, since the average traded volume across just four Indian cryptocurrency exchanges as of December 2020 stood at over USD 22.4 million / INR 163 crores daily. The trail of transactions is transparent and open to audit. By banning cryptocurrency, the exchequer would lose thousands of crores of revenue.

THREATS

Potential replacement for fiat currency:

There is a fear that cryptocurrencies have the potential to replace fiat currency (also a testament to the power of this technology), and be used for illicit activities such as money laundering and terrorism financing. However, such risks can be overcome by bringing cryptocurrencies into the fold of regulation and accountability[13] rather than by way of a ban. This allows regulators to define the role of cryptocurrencies in the formal economy and monitor their use. For instance, cryptocurrency exchanges could be required to use tools to match customer data with cryptocurrency transactions to identify high-risk customers and trace money laundering activities.[14] Consequently, Regulators need to adopt standards for the following:

a) Who can use cryptocurrencies: Measure to have individuals and entity that deal with cryptocurrencies register itself (either with a recognised crypto exchange or with the appropriate government) in compliance with Know-Your-Customer (KYC) identity verification procedures.[15] This helps in verifying the identities of individuals behind cryptocurrencies transactions. In addition, requiring entities which facilitate cryptocurrency transactions to follow anti-money laundering (AML) and counter terrorist financing (CFT) procedures such as submitting risk reports, risk assessments, customer due diligence and reporting suspicious activities, will help address money laundering and terrorism financing concerns.[16] Several jurisdictions such as the United States, European Union, Singapore have adopted strict KYC, AML and CFT requirements for cryptocurrency businesses.[17]

b) How should cryptocurrencies be used: Regulators may require that customers trade in cryptocurrency only on recognised cryptocurrency exchanges. This allows the regulator to monitor the operations of the cryptocurrency exchanges and require them to comply with KYC, AML and CFT procedures.[18] For instance, UK’s Financial Conduct Authority has made it mandatory for cryptocurrency exchanges to be registered with it to continue operating as a cryptocurrency exchange.[19]

c) Role of cryptocurrencies in the payments system: Specify that cryptocurrencies cannot be used as a legal tender and is not a part of the of the formal payments system. Several countries, who recognize the potential of blockchain such as Canada, South Korea, Singapore, United Kingdom and United States, allow the use of cryptocurrencies without recognizing them as legal tenders.[20] This ensures that cryptocurrencies never enter the formal payments system in India.

d) Classification of cryptocurrencies: Cryptocurrencies can be specifically classified as property, intangible commodities or business assets, further ensuring that they are eliminated as a part of the payments system. Countries have adopted different approaches. For instance, United States has classified cryptocurrencies as ‘property’ for federal tax purposes, thereby applying all general tax principles that are applicable to property transactions.[21] Canada, on the other hand, treats cryptocurrencies as ‘commodity’ like gold or silver, subjecting them to tax rules on barter trades.[22]

Taking active regulatory measures can ensure that cryptocurrencies are not considered as legal tender, are eliminated from the payments system and monitor their use.

Fuel for illicit or illegal activities:

Cryptocurrencies are not a fuel for illicit activities. In fact, despite common misconceptions, cryptocurrencies help in preventing and tracing money laundering and other illicit activities. This is because the technology can create a transaction trail,[23] covering the end-to-end history of the fund flow. Regulators can monitor cryptocurrency transactions in a way not possible with ordinary financial transactions.[24] In fact, although cryptocurrency transactions are considered to be ‘anonymous’, the identity of a person can be exposed since cryptocurrency transactions can be traced back to individuals whose personal details are stored with the cryptocurrency exchanges.[25]

For instance, using the cryptocurrency transaction trail, the FBI was able to uncover and take down a child-pornography website called ‘Welcome to Video’.[26] This was only possible due to public transaction history of bitcoin blockchain. The FBI was also able to trace the transaction to the site operator by tracing his personal phone number and email address.[27] Therefore, since blockchain provides a public record of every transaction, it is in fact useful in preventing and tracing money laundering. Nonetheless, while risk of illicit activities in cryptocurrency transactions, these can be mitigated by bringing cryptocurrencies into the fold of regulation as discussed at paragraph 1.1.1.

Ban on cryptocurrencies

Since the Supreme Court’s decision in March 2020 striking down the RBI’s circular banning cryptocurrency trading, there has been a significant growth in India’s cryptocurrency market. India’s cryptocurrency trading volume has risen by 500%.[28] Banning cryptocurrencies, a thriving market in India, will have adverse consequences for the Indian economy and result in the following:

(i) Push the entire industry underground: Banning the use of cryptocurrency is not an effective solution and will only push the cryptocurrency market underground and force them to operate illegally.[29] This will only result in the need for heavier regulation of the internet. Moreover, several cryptocurrency operators have put in place measures to work around the ban and ensure seamless functioning of the crypto markets. For instance, certain Bitcoin companies have satellites in space to ensure that bitcoin network is accessible in areas where internet is not accessible.[30]

(ii) Close the door on big tech: Big tech companies like Google, Amazon, Apple and Facebook are significantly investing in cryptocurrencies and making them more accessible through their payment gateways.[31] Further, a lot of cryptocurrency exchanges are accepting payments through Google Pay and Apple Pay.[32] In addition, billionaires like Tim Draper have also invested in Indian start-ups[33] dealing with cryptocurrencies. Banning cryptocurrency will close the door on significant investment from big tech and highly valued investors.

(iii) Erosion of wealth: During the lockdown, the Indian cryptocurrency market has seen a significant boom, with trading volume at $10-30 million.[34] Bitcoin has grown more than 700% in price terms since April 2020, Ethereum by 730% and Yearn Finance Token by 32 times.[35] Several Indian investors have also invested in cryptocurrency. For instance, of the $20-25 million trading seen on CoinDCX every day, 75% comes from Indian investors.[36] Global trading cryptocurrency exchanges have also invested in India. For instance, Binance Group has set up a $50 million blockchain technology fund for India to invest upwards of $100,000 per start-up,[37] and UAE’s digital asset exchange Major Bitex has launched its fully-regulated cryptocurrency wallet and trading platform in India.[38]There has also been a significant institutional acceptance of the use of cryptocurrencies in India. Several top banks in the country, including HDFC Bank, State Bank of India, ICICI Bank and Yes Bank have also started offering working capital or other loans and financial services to cryptocurrency exchanges.[39] Therefore, there has been a lot of wealth creation in the cryptocurrency industry during the lockdown. Banning cryptocurrency will result in erasure of wealth and force investors and customers to liquidate their investment.

(iv) Erosion of talent: India’s tech entrepreneurs are at the forefront of building products based on blockchain technology.[40] Banning cryptocurrency will result in erosion of significant new talent in India, as start-ups and entrepreneurs investing in blockchain and cryptocurrencies will shift their base product base to countries where cryptocurrencies are legal.

This representation has been authored by the team at Ikigai Law.

For more on the topic, please feel free to reach out to us at contact@ikigailaw.com

[1] Foundation for Economic Education, IMF Head Foresees the End of Banking and the Triumph of Cryptocurrency, available at https://fee.org/articles/imf-head-predicts-the-end-of-banking-and-the-triumph-of-cryptocurrency/, last accessed on 06.02.2021.

[2] How banks can succeed with cryptocurrency, by Zubin Mogul, Bernhard Kronfellner, Michael Buser, Chi Lai, Kenneth Wee, Will Rhode, Kaj Burchardi, Anna Golebiowska, Pratin Vallabhaneni, John Wagner, and Alexander Abedine, available at– https://www.bcg.com/publications/2020/how-banks-can-succeed-with-cryptocurrency, last accessed 06.02.2021.

[3] Business Insider, Warren Buffett blasted Bitcoin as a worthless delusion and ‘rat poison squared.’ Here are his 16 best quotes about crypto, available at https://www.businessinsider.in/stock-market/news/warren-buffett-blasted-bitcoin-as-a-worthless-delusion-and-rat-poison-squared-here-are-his-16-best-quotes-about-crypto-/articleshow/80303445.cms#:~:text=Warren%20Buffett%20has%20repeatedly%20criticized,past%20year%20to%20record%20highs, last accessed 06.02.2021.

[4]National Digital Health Misssion Sandbox ver. 1.0, available at https://ndhm.gov.in//assets/uploads/Sandbox_Guidelines_v6.pdf, last accessed on 06.02.2021

[5] A strategist’s guide to blockchain, by John Plansky, Tim O’Donnell and Kimberly Richards, available at https://www.strategy-business.com/article/A-Strategists-Guide-to-Blockchain.com last accessed 06.02.2021.

[6] See Global Charts: Total Market Capitalisation,available at https://coinmarketcap.com/charts/, last accessed on 06.02.2021

[7] As per current estimates Uber is valued at USD 120 billion; Slack in valued at USD 27 billion; and Airbnb at just over USD 100 billion.

[8] The New York Times, Why bitcoins matter, available at https://dealbook.nytimes.com/2014/01/21/why-bitcoin-matters/ , last accessed on 06.02.2021.

[9]World Bank (2014). Global Findex 2014 – Financial Inclusion.

[10] Ericsson Mobility Report (2015). On the Pulse of the Networked Society.

[11]How banks can succeed with cryptocurrency, by Zubin Mogul, Bernhard Kronfellner, Michael Buser, Chi Lai, Kenneth Wee, Will Rhode, Kaj Burchardi, Anna Golebiowska, Pratin Vallabhaneni, John Wagner, and Alexander Abedine, available at– https://www.bcg.com/publications/2020/how-banks-can-succeed-with-cryptocurrency, last accessed on 06.02.2021.

[12] Schmidt Kai Uwe. (2017). Solving Development Challenges in Underdeveloped Countries: An Analysis of Blockchain-Based Applications (Bachelor Thesis). Frankfurt School of Finance & Management, Frankfurt.

[13] Deloitte, Regulating cryptocurrencies, at 51, (2018), available at, https://www2.deloitte.com/content/dam/Deloitte/xe/Documents/About-Deloitte/mepovdocuments/mepov25/cryptocurrencies_mepov25.pdf.

[14] Elliptic, Bitcoin Money Laundering: How Criminals use Crypto, 18th September 2019, available at, https://www.elliptic.co/blog/bitcoin-money-laundering.

[16] Sygna, What is AML/KYC in Crypto?, available at, https://www.sygna.io/blog/what-is-aml-kyc-in-crypto/.

[17] See

[18] Norton Rose Fulbright, Cryptocurrency exchanges and custody providers: International regulatory developments, October, 2018, available at, https://www.nortonrosefulbright.com/en-us/knowledge/publications/e383ade6/cryptocurrency-exchanges-and-custody-providers-international-regulatory-developments

[19] Financial Conduct Authority, Cryptoassets, https://www.fca.org.uk/consumers/cryptoassets.

[20] OpenNode Team, Bitcoin Regulation: Which Countries are Bitcoin-Friendly, 6th February, 2020, available at, https://www.opennode.com/blog/bitcoin-regulation-which-countries-are-bitcoin-friendly/.

[21] Internal Revenue Service, Notice, (2014), available at, https://www.irs.gov/pub/irs-drop/n-14-21.pdf.

[22] Commonwealth Working Group on Virtual Currencies, Regulatory Guidance on Virtual Currencies, Working Group Report at 29, (2019), available at, https://thecommonwealth.org/sites/default/files/key_reform_pdfs/D16999_GPD_Virtual_Currncs.pdf.

[23] Tom Robinson, ?Crypto can prevent money laundering better than traditional finance, Venture Beat, 20th July 2019, available at, https://venturebeat.com/2019/07/20/crypto-can-prevent-money-laundering-better-than-traditional-finance/.

[24] Id.

[25] Tyler Newby and Ana Razmazma, An Untraceable Currency? Bitcoin Privacy Concerns, Fintech Weekly, 7th available at, https://fintechweekly.com/magazine/articles/an-untraceable-currency-bitcoin-privacy-concerns.

[26] Lily Hay Newman, How a Bitcoin Trail Led to a Massive Dark Web Child-Porn Site Takedown, Wired, 16th October, 2019, available at, https://www.wired.com/story/dark-web-welcome-to-video-takedown-bitcoin/.

[27] Id.

[28] Advait Papelu, Indian Crypto Currency Trading Volumes Grow 500% Since March, Medianama, 16th December, 2020, available at, https://www.medianama.com/2020/12/223-indian-crypto-currency-trading-volumes-grow/#:~:text=The%20average%20daily%20crypto%20currency,(RBI)%20April%202018%20circular..

[29] Nick Spanos, Stifling Innovation with Regulation: Why Countries Shouldn’t Ban Cryptocurrency Trading, Blockchain Expo, 2nd February, 2018, available at, https://www.blockchain-expo.com/2018/02/blockchain/banning-cryptocurrency-is-definitely-not-an-option-we-would-recommend/.

[30]Id.

[31] Finance Magnates, Big Tech is Making Cryptocurrency More Accessible Than Ever, 20th October, 2020, available at, https://www.financemagnates.com/thought-leadership/big-tech-is-making-cryptocurrency-more-accessible-than-ever/.

32] Id.

[33] VC Circle, Billionaire Tim Draper, others invest Series A money in crypto exchange Unocoin, 8th October, 2020, available at,https://www.vccircle.com/billionaire-tim-draper-others-invest-series-a-money-in-crypto-exchange-unocoin/.

[34] Business Line, Amidst Covid lockdown, cryptocurrency trading sees a boom, 14th July 2020, available at, https://www.thehindubusinessline.com/money-and-banking/amidst-covid-lockdown-cryptocurrency-trading-sees-a-boom/article32059823.ece.

[35] The Economic Times, India getting infatuated with Bitcoin, says top cryptocurrency exchange, available at, https://economictimes.indiatimes.com/markets/stocks/news/india-getting-infatuated-with-bitcoin-says-top-cryptocurrency-exchange/articleshow/80263182.cms?from=mdr.

[36] Livemint, Indians are spending millions daily on cryptocurrency trading, 2nd December, 2020, available at, https://www.livemint.com/news/india/indians-are-spending-millions-daily-on-cryptocurrency-trading-11606906191740.html.

[37] Economic Times, Cryptocurrency exchange Binance sets up $500million Indian blockchain fund, 17th March, 2020, available at, https://economictimes.indiatimes.com/small-biz/startups/newsbuzz/cryptocurrency-exchange-binance-sets-up-50-million-indian-blockchain-fund/articleshow/74665232.cms?from=mdr.

[38] AIT News Desk, UAE Digital Currency Exchange Major Bites Enters India, 10th November, 2020, available at, https://aithority.com/technology/cryptocurrency/uae-digital-currency-exchange-major-bitex-enters-india/.

[39] Bloomberg, Bitcoin Rally Draws First-Time Buyers in India but also Fraudsters, 7th January 2021, available at, https://www.bloombergquint.com/markets/bitcoin-rally-draws-first-time-buyers-in-india-but-also-fraudsters.

[40] Entrepreneur, Leveraging the power of blockchain: 4 Indian entrepreneurs who embraced technology in their business models, 13th October, 2020, available at, https://www.entrepreneur.com/article/357693.