This blogpost addresses a number of frequently asked questions around cryptocurrency and blockchain technology. It addresses some key issues such as blockchain existing in the absence of cryptocurrency, the government’s concerns on cryptocurrency and how they can be addressed, and what a ban on cryptocurrency will lead to. This blogpost explains all these issues and more in a simple manner.

What is blockchain and why is everyone talking about it?

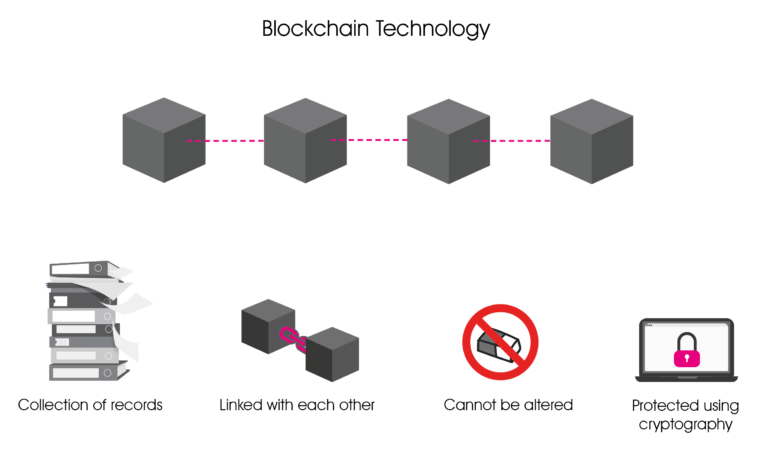

Blockchain is a tamper-proof electronic ledger. Think of it the same way as you would an accounting ledger book, a cash book, a land title register or a medical health file. The key difference is that records in a typical accounting book or land title register can be manipulated, but not on the blockchain.

Record keeping requires a record keeper that you can trust. However, sometimes the record keeper can engage in fraud and corruption. Additionally, the record keeper charges a fee for its services. Blockchain makes records immutable and tamper-proof such that you no longer need a record keeper in between.

Removing this intermediary, blockchain mitigates the risk of fraud and corruption and makes transactions frictionless, fast and cost-effective. Blockchain helps you do away with intermediaries such as escrow agents, share custodians, health-record companies and money transmitters – anyone who brokers a transaction and charges a fee to introduce an element of trust in the system. Take the example of money transmitters who help Indian workers in Dubai to remit money to their families in Kerala. In 2018, India received over USD 83 billion in inward remittances. The estimated cost of these was USD 4.1 billion. Remittance through blockchain would have cut out the intermediaries, reducing this cost by 60% translating to saving of INR 18,000 crore per year.

Everything we do requires record keeping – financial services (lending and payments), health services (vaccine delivery, hospital management), governance (subsidies and cash benefits, courts) or managing data privacy. So, blockchain holds the potential to impact every aspect of life and governance.

How does blockchain work?

Blockchain technology connects millions of computers (much like the internet) that can all store/host encrypted copies of these records. So instead of one record keeper, you have millions of record keepers called ‘nodes’. One record keeper can tamper records, collude with third parties and commit fraud, but now there are a million nodes who are keeping a watch on each other.

Much like the internet provides an infrastructure for communication, blockchain provides an infrastructure for record keeping.

Are cryptocurrencies different from blockchain?

If we could take come creative liberties, blockchains are designed to use cryptocurrencies as “points” for writing records on the blockchain. Cryptocurrencies are therefore different from blockchain, but, yet, an integral part of blockchain technology.Cryptocurrencies ensure that there is an economic incentive to host the records. A blockchain may be designed to not use cryptocurrencies, but such use of blockchains may be limiting and expensive.

Let’s dive deeper.

Think of blockchain as a record-keeping infrastructure of millions of interconnected user-nodes. These user-nodes build and maintain this record-keeping infrastructure and also use it for their own record keeping. The technology is designed in a way that user-nodes need “points” to write their records. When the users host records on the blockchain infrastructure, they collect these points as fee from other users. And then the users use these points to write themselves. This makes the blockchain ecosystem self-sustaining without depending on any government or organisation owning, building and maintaining it. If there are no ‘points’ for the user-nodes, then there is no incentive for these user-nodes to contribute to the blockchain ecosystem.

To be able to access the service of a blockchain, users need to ‘pay’ the user-node, and the native cryptocurrency of that blockchain system is the mode of payment. It is an economic exchange in return for a service, the user needs to give something of economic value to the service provider i.e. the ‘node’. Thus, a self-sustaining blockchain i.e. “public” blockchain is not possible without cryptocurrencies.

However, a “private” blockchain that is built and maintained by someone privately (for eg., a CBDC blockchain run by the government) may be designed to not need cryptocurrencies.

It is for this reason that cryptocurrencies should not be seen as a currency. The name cryptocurrency is a misnomer. They do not serve as an alternative to the Rupee or other fiat currency. They really are an asset/software that is used to write on the blockchain and for incentivising the nodes – if at all they serve as an instrument for payments, this use case is limited to within the blockchain ecosystem to incentivise the nodes.

Why can’t you just pay the nodes dollars for their services? Why incentivise the nodes with cryptocurrencies?

Much like the internet, the blockchain infrastructure runs across the globe with millions of nodes writing billions of new records every second i.e. it is a decentralized system. This ensures that the blockchain infrastructure does not have a single point of failure, which could otherwise threaten the entire infrastructure.

These nodes are paid fractions of a dollar for every micro-transaction. It is impossible to use the existing fiat money infrastructure to make real-time, micro-payments to millions of nodes across the world. Fiat money payments have to pass through intermediaries such as banks, money changers, card networks etc., and are subject to friction, delays, exchange rate fluctuations, transfer charges, and other cost inefficiencies.

What are the government’s concerns around use of cryptocurrencies?

The government is concerned about- (1) the use of cryptocurrencies for illicit activities – tax evasion, money laundering, terrorism financing; and (2) loss of control over monetary policy and flight of capital overseas.

Are the government’s concerns valid?

Yes. However, all new technologies pose risks. The question is whether these risks can be mitigated and managed to a reasonable extent such that the benefits of the technology outweigh the risk. There were concerns around the use of the printing press (jobs), automobiles and aeroplanes (safety), internet (surveillance-free communication) as well, as with many new technologies such as artificial intelligence, drones and robotics. A ban is usually not a good answer to regulating new technologies.

How can the risks imposed by cryptocurrencies be mitigated and managed?

Regulation can solve for this concern. Across the world, regulators (including in the US, Singapore, Japan, Dubai and UK) have evolved regulation to solve for this issue. Licensed intermediaries (crypto-exchanges) can help the regulator maintain oversight and control over cryptocurrency transactions through mandatory requirements such as extensive know-your-customer or KYC checks on traders, taking anti-money laundering measures and maintaining transaction records. This is how existing financial institutions such as banks and stock exchanges keep track of financial transactions and verify customer identity. A dashboard can be made accessible to all relevant authorities to provide real-time trading data in relation to all exchange users in India; and trade of cryptocurrencies can be restricted to only those users whose addresses have been whitelisted by licensed exchanges in India. These features can provide substantial controls to the regulator to monitor flows of cryptocurrencies and restrict them to verified/legitimate users. We also propose creation of a central repository with details of blacklisted users and formation of an investor protection and education fund.

What will be the effects of a ban on cryptocurrencies?

A ban will deprive India, its entrepreneurs and citizens of a transformative technology – as foundational as the internet itself – that is being rapidly adopted across the world, including by some of the largest enterprises such as Tesla and Mastercard. It will overnight erase enormous amounts of wealth held in cryptocurrencies by over fifty lakh Indians and deprive them of one of the greatest wealth-creation opportunities of the next decade.

Banning cryptocurrency, and not regulating it, will likely create a parallel economy where its illegitimate uses (such as for illicit trade or money laundering) will increase and legitimate uses will be abolished. This is what happened when the RBI imposed a banking ban on crypto-businesses in 2018- the largest crypto-startups in the country shut down. And all trade in cryptocurrencies moved away from responsible and sophisticated crypto-exchanges that followed safeguards such as extensive know-your-customer or KYC checks on traders, anti-money laundering measures and maintaining transaction records. Instead, over-the-counter platforms sprung up on Telegram channels that deal in cash and maintain no records.

There is a fear that traders may purchase cryptocurrencies using unaccounted money and use it for illicit transactions. This fear remains even if cryptocurrencies are banned. Any person can purchase cryptocurrencies over the internet in any case. However, since cryptocurrency create a public record of every transaction, it is in fact useful to prevent and trace crime. For example, using the cryptocurrency transaction trail, the FBI was able to uncover and take down a child-pornography website called ‘Welcome to Video’. The FBI was also able to trace the transaction to the site operator by tracing his personal phone number and email address. Merkle Science, a Singapore-based start-up founded by Indians, assists law enforcement agencies and regulators to investigate illicit cryptocurrency transactions and conduct diligence on the good practices adopted by crypto exchanges.

This bill provides for building a digital currency issued by the RBI. Let’s start with that?

Issuing a digital official currency is a good idea for India. However, issuing a digital official currency but excluding other ‘private cryptocurrencies’ is not a good idea. Imagine it is the year 1993 and the government is concerned about the use of the internet by terrorists to send emails. To address this, the government builds its own email service. Had things played out in this manner, we would have lived with a singular email application and would not have benefitted from Yahoo mail, Hotmail, Rediffmail, and Gmail. This would have also prevented the creation of various internet-based applications such as social media (Facebook), chat services (WhatsApp), video steaming (Netflix) and e-commerce platforms (Flipkart) that were built privately on top of the internet. And, India would have cut herself off from the global digital infrastructure for e-mail communication. If the existing 1500 cryptocurrencies are the various applications of the internet, then an RBI-backed cryptocurrency will be akin to a local area network or a home wifi – limited in its potential and not inter-operable with other applications being built, and not allowing other developers to innovate on top of it. It is risky to reduce the potential of all cryptocurrency applications to their use as currency; much like it would have been to reduce the internet down to email.

Further building an RBI-issued digital currency will be a multi-year project. To create a digital currency, tender it out, pilot it and eventually build it out on a pan-India level will take time. A few other countries that have declared their intention of building out centrally backed cryptocurrencies are merely evaluating these decisions from a policy standpoint or running pilots. For example, China has been running pilots since 2017. Hence, while India should pursue its ambition of having a digital currency, this project will not fill the vacuum left by a ban on “private cryptocurrencies” today.

Some state governments have already implemented blockchain based projects that do not require cryptocurrencies. Then why do we need cryptocurrency?

As discussed above, these projects are akin to building a local area network or a home wifi, and not the internet. Such localised projects can and should co-exist with other private innovation. Further, such projects, whether it is the ‘digital Rupee’ or state-run land records management, will require the government to build the entire infrastructure at its own cost. When these projects use an existing privately-built cryptocurrency network, the infrastructure is already built and can be used on a pay per use model. It is relatively easy to replace the infrastructure and move to a better service. Should such government services be operated on privately operated infrastructure? Yes, many government applications operate on the open internet. Additionally, the true potential of this technology is realised when it is used in a decentralised fashion. When centralised (i.e., when it is run by the government or an organisation on its own infrastructure), the records are only as safe as the central server is. A decentralised project on the other hand does not have a single point of attack and is considered highly secure.

Additionally, private blockchains are like centralized databases that are not interoperable. They will only result in isolated silos of information or data which will not be able to interact with each other. However, a public blockchain infrastructure will also offer interoperability.

What is the intrinsic value of cryptocurrencies? They work purely on demand and supply. Given its volatility, isn’t it an extremely unsafe class of financial assets, and open to manipulation?

Cryptocurrencies have an inherent utility as a technology. People also buy them to use them as a monetary asset, and demand and supply determine their value. Now this is similar to buying land – you can buy land to use it (build a house etc) or invest in it. Likewise, people invest in cryptocurrencies. These investments are used by cryptocurrency developers to fund further development of their projects. Given the tremendous potential of this technology, investments here will reap high returns. Taking a note of this companies such as Tesla are investing their treasury reserves in to bitcoin.

Interestingly, cryptocurrencies have delivered the highest returns on investments in a ten-year period than any other asset class in a lifetime. This is also to say that a critical mass of investors believe in the potential of the underlying technology.

Yes, cryptocurrencies can be volatile and open to speculative trades. There have been reports of frauds and market manipulation. However, such activity can be regulated through licensed intermediaries. For instance, certain countries only allow sophisticated investors (having a threshold net worth) to invest in cryptocurrencies.

Are cryptocurrencies energy inefficient?

Yes, some cryptocurrencies such as bitcoins require a high amount of energy for ‘mining’ them. However, cryptocurrency mining activity in India is negligible. Electricity supply issues and unfavourable weather conditions make India an unfeasible market for cryptocurrency mining. India had also reportedly banned the import of a specific component of cryptocurrency mining equipment called ‘application-specification integrated circuits’ or ASIC. This is probably why cryptocurrency trading is far more popular in India than cryptocurrency mining.

Nevertheless, advancements in technology are beginning to address this concern. A commonly used technique for cryptocurrency mining, called ‘proof of work’ or PoW validation, is an energy inefficient technique. Instead, a highly energy efficient technology called ‘proof of stake’ or PoS is increasingly being used. Ethereum, the world’s second-largest cryptocurrency,[1] is currently transitioning from a PoW to a PoS validation model.[2]

Further, access to cheap electricity is important for miners, as they won’t have any incentive to continue mining if its cost exceeds the profit earned by them through selling bitcoins. Consequently, many cryptocurrency miners use renewable-energy based electricity, as it is generally cheaper than coal-produced electricity. For example, a study by Cambridge University found that over 39% of the total energy consumed by cryptocurrencies including Bitcoin, Ethereum, Bitcoin Cash and others comes from renewable energy sources.[3] Cryptocurrency mining in Iceland runs almost completely on renewable energy.[2] This helps to reduce the harmful environment impact of cryptocurrency mining.

This representation has been authored by the team at Ikigai Law.

For more on the topic, please feel free to reach out to us at contact@ikigailaw.com

[1] https://www.cnbc.com/2021/02/05/bitcoin-ether-eth-cryptocurrency-hits-new-ath-above-1700.html.

[2] https://ethereum.org/en/developers/docs/consensus-mechanisms/pos/.

[3] https://cointelegraph.com/news/report-76-crypto-miners-use-renewables-as-part-of-their-energy-mix.