“The power and beauty of physical laws is that they apply everywhere, whether or not you choose to believe in them. In other words, after the laws of physics, everything else is opinion.”

Neil DeGrasse Tyson, Astrophysics for People in a Hurry

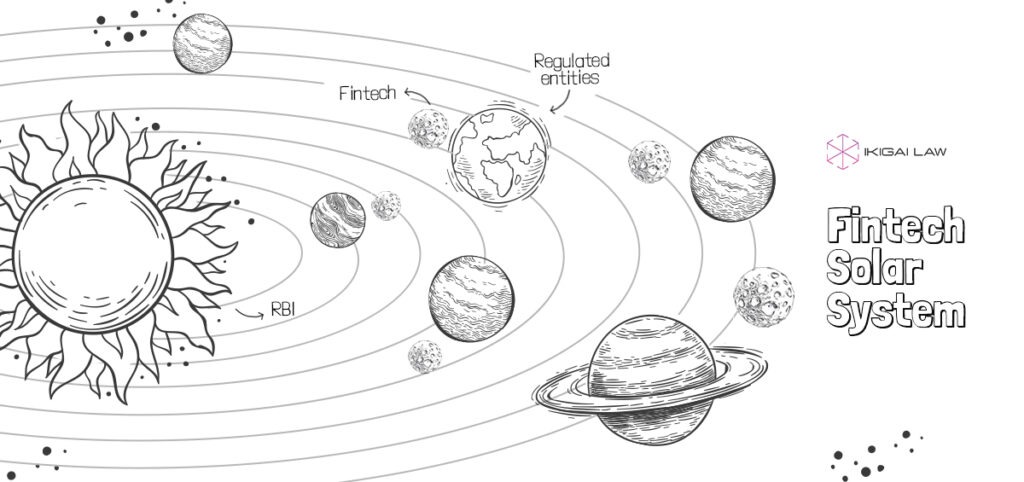

The law of gravity guides planets, asteroids, and comets in their orbit around the Sun. It’s a fundamental force which affects everything in our cosmos. Regulation, much like gravity, is an all-pervasive background force which holds our financial system together.

At the center of the fintech solar system is the RBI (the Sun). The RBI’s gravitational force keeps regulated entities like banks and NBFCs (the planets) in orbit. These regulated entities, in turn, keep their fintech partners (the satellites) in their orbital path. But what happens when these satellites grow too big or distant? If the planet’s gravitational force isn’t strong enough, its satellites may stray too far and cause Armageddon in our fintech solar system. It’s this instability that our Sun – the RBI – is grappling with.

Last month, the RBI prohibited prepaid payment instrument (PPI) issuers from loading PPIs using credit lines. This notification debilitated several buy-now-pay-later (BNPL) businesses in India. In another stringent move, the RBI also imposed a Rs.1.68 crore penalty on Ola for non-compliance with PPI and KYC norms. The RBI’s Payments Vision 2025 and Financial Stability Report 2022 offer clues about why it took these drastic steps. Fintech players are moving at breakneck speed. And the regulator fears they may reach escape velocity.

Dig into our four-course FinTales menu to explore how this cosmic tussle between regulators and fintech businesses may play out.

Appetizers: snackable updates about recent fintech developments.

Main-Course: a salad to help BNPL recover from the prohibition on loading PPIs with credit lines. And a hi-carb bowl of oatmeal to help payment players prepare for the 3-year marathon of achieving the RBI’s Payment Vision 2025.

Palate Cleanser: a break from the fintech menu.

Dessert: some pepper-mint ice-cream to serve as a wake-up call about DeFi but also explain why it’s the lesser of two evils.

*********************************************************************************

Appetizers ?

? Card tokenization deadline extended

The woods are lovely, dark and deep,

But I have ‘deadlines’ to keep,

And miles to go before I sleep.

~ India’s card payment industry

With the deadline looming, the card payment ecosystem was ill prepared to implement tokenization. So, the RBI (finally) relented. It extended the card data purging deadline to 30 September 2022. There are 1 billion debit and credit cards in India. And as of now, only 195 million tokens have been generated. Only a fraction of the work is done. Even generated tokens haven’t been adequately tested for transaction processing. Refunds and chargebacks are also a challenge for token-based transactions. The 3-month extension is welcome. But for the card payment industry, there are miles to go, with no sleep in sight.

? More isn’t merrier for UPI app providers

PhonePe and Google Pay together hold 81% of the UPI market share. To contain this duopoly, the NPCI asked players to cap their respective market-shares to 30% by 1 January 2023. Reportedly, the NPCI may extend this deadline. But now parliamentarians have expressed concern about the concentration risk in UPI. They plan to raise this issue in the upcoming monsoon season of the parliament. Once the parliament turns its attention on this issue, the ball will no longer remain (just) in NPCI’s court. Much like the debate over Merchant Discount Rate (MDR) capping – UPI market share may soon become a political hot-potato.

? Tax deduction at source, volume deduction at exchanges

The Central Board of Direct Taxes has clarified how the 1% withholding tax (popularly ‘TDS’ or Tax Deduction at Source) on transfer of cryptos and NFTs can be collected and deposited. The clarification suggests practical ways of collecting the TDS. For example, Virtual Digital Asset (VDA) exchanges can deduct TDS for VDA trades on their platform, to ease compliance burden on their users. For the industry though, a 1% levy for each VDA trade remains impractical. And is likely the cause of more than 70% dip in trading volumes.

? What exactly is an NFT?

Many have tried and failed to explain what an NFT is. And it’s now the Indian government’s turn. If you recall, NFTs are VDAs under law. And income from their transfer will be taxed at the same rate (30%) as other VDAs (like Bitcoin). The government’s explained that any token which can qualify to be a VDA is an NFT. Put simply, if something can be a VDA, it can also be an NFT. If you ask me, this is the legal equivalent of introducing a new character, without them affecting the plot. But there’s one material exception – NFTs whose transfer results in an enforceable transfer of ownership of the underlying tangible asset (like real estate) are not VDAs. Likely because the government plans to continue taxing transfers of the underlying tangible assets the way it already does.

**********************************************************************************

Main-course ?

??⚖️ When you hear a regulatory song, tune-up and sing along

Last month, the RBI issued a circular which prohibited loading PPIs through credit lines. This sent shockwaves across the fintech universe because most BNPL products follow this model. As the dust settles, we explore what BNPL players can do to survive.

First, BNPL players must steer clear of what the RBI deems unacceptable: lending, holding, and moving public funds (without a license to do so). Lending (to customers) and settling funds (to merchants) is a regulated activity which BNPL players must not encroach on. These functions must be left to their regulated partners (banks, NBFCs, and payment system providers).

Second, proactive engagement with the regulator is needed to fast-track regulatory acceptance of BNPL. The RBI is concerned about risks like improper credit-risk assessment by algorithms, high default rates, lack of credit bureau reporting, and first-loan-default-guarantees by unregulated entities. The industry must proactively engage with the RBI to address these concerns.

Third, going forward, BNPL players may face a higher compliance burden if they rely on licensed entities to perform lending or payment functions. The RBI recently proposed a rehaul of the IT outsourcing framework. The proposed norms require banks and NBFCs to exercise greater control over their outsourced service providers (OSPs). So, BNPL platforms (acting as OSPs) may have to comply with additional obligations. Like reporting cyber security breaches to their regulated partner within 1 hour of discovery.

As a silver lining, the RBI intends to issue guidelines for BNPL products soon. And these guidelines may provide much needed regulatory certainty. We spoke to Meenakshi Kolay, a fintech industry veteran, about her expectation from upcoming regulations. “The regulator must clarify the construct of acceptable BNPL product flow”, she said. “Lack of proper user KYC while onboarding BNPL users has been one of the key concerns. So, the regulations must also clarify the KYC norms that BNPL players must follow”, she added.

? Fintech’s guide to the payment-verse

After decades of research, the Hubble Telescope precisely estimated the expansion rate of the Universe this year. The magic figure is a little over 1%. Closer home, the Indian payments universe has been expanding more rapidly. The RBI’s Payments Vision 2025 (Vision) reveals that digital payments increased 216% in volume and 10% in value (between 2019-2022). The Vision also sheds light on how the RBI intends to keep the payments universe growing in an orderly manner over the next three years. Let’s unpack some of the RBI’s proposals.

First, the RBI has proposed mandating processing of payment transactions exclusively in India. Currently, all payments data must be stored only in India. But it may be processed offshore subject to certain restrictions. If the RBI implements this proposal, industry players may need to re-structure their data processing activities. This will increase transaction processing costs, especially for card networks.

Second, the RBI plans to review the guidelines for PPIs. In particular, the RBI’s proposal to re-examine the definition of closed PPIs could have far-reaching implications across industries. A closed PPI is an instrument which can only be used to purchase goods or services from the issuer (of the instrument). Since closed PPIs aren’t used to pay third-parties, the RBI has so far refrained from regulating them. As a result, apps ranging from food delivery to gaming offer in-app wallets that users can load funds into. And make payments. But if the RBI implements this proposal, many of these in-app wallets could face tighter regulation.

Third, the RBI will explore linking UPI with credit cards and other credit products. The RBI has already green-lit linking of Rupay credit cards with UPI. What, however, remains to be seen is whether the RBI will allow linking of loan accounts and credit lines with UPI. Currently, credit payments can be made via UPI only through an overdraft facility (in a bank account). But if loan accounts and credit lines are linked to UPI, BNPL players can leverage UPI’s vast merchant acceptance network.

Fourth, to avoid delay in settlements to merchants, the RBI is planning to set up a new payment system to process merchant transactions made through internet/mobile banking channels. The introduction of this payment system may be a body-blow to PAs. PAs, however, can counter the threat by providing superior customer support.

Fifth, the RBI is devising a National Card Switch to process all point-of-sale card transactions. Currently, card networks process these transactions through their respective switches. The introduction of a National Card Switch may increase competition and lower switching fees.

We spoke to Vishal Mehta, Chairperson of the Merchants Payment Alliance of India, about the Vision’s proposals. “By setting up a National Card Switch, India can get in the league of the US, Singapore & Australia which have made debit card transactions cost competitive for merchants, although similar initiatives are undertaken by private networks in these countries,” he explained. “The impact of RBI regulations on merchants and end consumers can be a blind-spot. We hope that regulation takes into account these impacts and makes merchants a party to the Payments Vision 2025,” he added.

**********************************************************************************

Palate Cleanser ?

See the Universe like never-before in these images taken by the Webb Telescope which marks a new era in astronomy.

**********************************************************************************

Dessert ?

? The democracy of finance and its fallacies

Democracy is transparent, gives masses the power, and in some cases, quicker. Promises of decentralised finance (DeFi) are similar. It’s democracy, for finance. DeFi’s proponents believe it’s the answer to all of traditional finance’s problems – costs, speed, transparency and over-reliance on a powerful intermediary. But lately, the roots of this newfound democracy have started to shake.

Solend is a decentralised lending and borrowing protocol on the Solana blockchain. Recently, the price of a large borrower’s collateral was sliding, and liquidation of their collateral loomed large. In an unprecedented move, the Solend community (remember they’re decentralised) voted to take control of this borrower’s account. The reason – liquidation at such a scale (21 million USD worth of collateral) could congest the Solana network and crash it. The community’s vote would allow liquidation of borrower’s collateral through a private trade (instead of open markets like exchanges). And save the day. That’s democracy, right? Wrong, the proposal passed with around 1.1 million ‘yes’ votes, with a million of them from one user (because they held as much voting rights). Who introduced the proposal? Solend’s co-founder. Even if these facts are brushed aside, the act of taking over an account belies DeFi’s core tenet of decentralisation. The community overturned this vote later, but not before Solend’s decentralisation became dubious.

DeFi exists because it promises disintermediation. But like in Solend’s case, centralisation has found ways to creep into decenterland. In most cases, it’s either by design (where the community has no material decision making power) or by concentration of voting power (where a few have disproportionate voting power). A report from Chainalysis, a blockchain data firm, reveals that across 10 major decentralised projects, less than 1% of all holders have 90% voting power. Unlike the one person, one vote principle in democracies, DeFi allows a person to have multiple votes (much like shareholders in a company). The Bank for International Settlements (BIS), a global collective of central banks, asserts that some level of centralisation is inevitable and that DeFi is an illusion. Gary Gensler, chairman of the US Securities and Exchange Commission, agrees. The concern, however, is that questions around centralisation of decentralised projects have been around for a while now.

Powers can remain with a few, powerful intermediaries may emerge, and voting can be unfair. So, is democracy a facade? Or is it still better than every other system? Whatever your answer is, so is DeFi.

*********************************************************************************

That’s

it from us. We’d love to hear from you. Tell us what you think about the

stories we covered. You can write to us at contact@ikigailaw.com. See

you in August.

If you enjoyed this edition, do share it with colleagues and friends.