As we get more clarity with a definition of cryptocurrencies and digital assets, it might cause headaches to another burgeoning industry in India – online video games.

Finance minister Nirmala Sitharaman’s announcement in the 2022 Union Budget of proposing a 30% tax on digital assets and cryptocurrencies has brought a flurry of reactions. Proponents of cryptocurrency call this a move towards legitimacy, but skeptics ask people to hold their celebrations as these announcements are simply reiterating the government’s existing position that income gained through cryptocurrencies will be taxed, regardless of its legality.

However, the explanation in the Finance Bill is instructive in what the government considers a digital asset. Digital assets now are defined as a representation of value, be it information, code, a token, that is generated by cryptographic or other means and are traded or stored electronically. Accordingly, the definition of a digital asset might affect another rising industry in India – online games and digital entertainment whose life blood is players purchasing in-game currency.

Games people play

The online games industry has seen a massive surge with the pandemic forcing people indoors. The global video games industry size is estimated to be over $175 billion in 2021. In India, the video games industry is still nascent but rising and was estimated to be around $930 million in 2020. Microtransactions and in-game purchases are becoming the driving force of growth of the industry currently. With increased smartphone penetration, casual and mobile games are leading revenue generators with consoles and personal computers following.

Though most mobile games are advertised as free-to-play, they are monetised when players purchase in-game items or currency. Some of these are used to buy skins for characters which have no effect on gameplay and are purely cosmetic. However, some games include a “loot box” mechanism, a digital crate of random items designed to give players an edge in online tournaments or games.

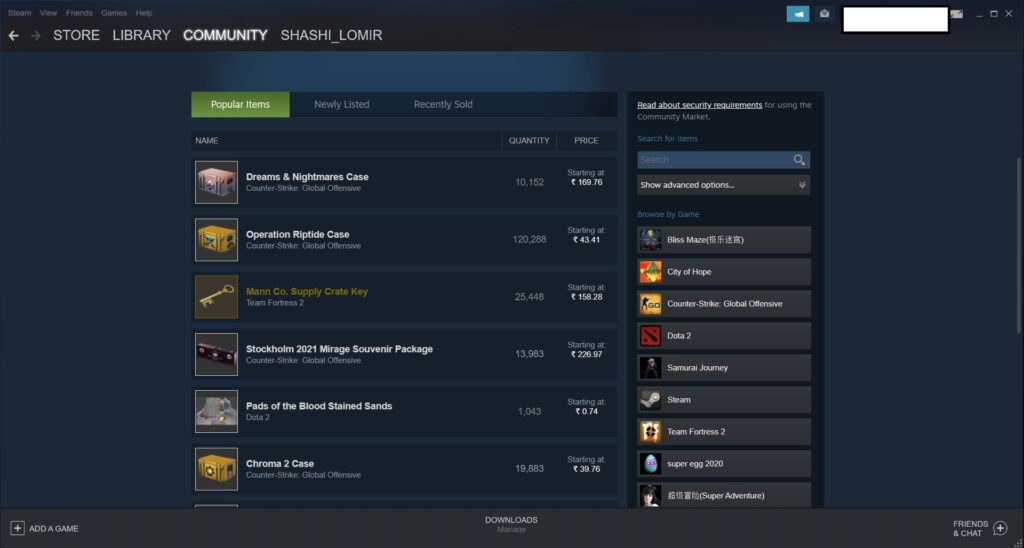

Take for example the wildly popular Counter-Strike: Global Offensive (CS:GO) which has a roaring microcosm of an economy where loot boxes and items are bought and sold by players.

Similarly, Fortnite, a battle-royale style game and runaway success from Epic Games, has an in-game currency called V-Bucks where players can earn through gameplay or purchase using real currency for skins and unlock features. Fortnite also has a system called “battle pass” which can be purchased and during a session players are rewarded with more items to progress through the game more quickly. In mobile games, consider Clash of Clans, a turn-based strategy game where players can buy gems to allow for more turns to play in a day.

The need for clarity

Online game companies argue that these in-game currencies should not be considered taxable income since they cannot be converted to fiat currency and are only valuable within the game’s ecosystem.

But the Finance Bill’s definition of a digital asset being a representation of value could apply to in-game currencies and items.. The finance bill goes on further to expand the definition to cover the current darling of the cryptocurrency world, non-fungible tokens (NFTs). The finance bill also makes it clear that recipients of gifted digital assets will also be taxed. For the gaming industry, emphasis must be drawn with the government expanding the scope of the definition to representations of value generated by other means. The majority of in-game currencies are not generated by cryptographic means but they do represent a store of value.

Hypothetically, if this definition is applied to in-game currencies it would lead to some interesting outcomes. For example, if a child is gifted V-Bucks card worth Rs 1,000 for their birthday because they like playing Fortnite, would the child be subject to 30% tax? Let’s expand this example further, if a professional e-sports player is awarded a certain amount of in-game currency in a tournament, would the winnings be taxable? Would the purchase of a collectible using in-game currency qualify as a transfer and be subject to tax?

There is some precedence for taxing in-game currencies as well. The United States Internal Revenue Service (IRS) had issued a notification on virtual currency in October 2019 and classified in-game currencies such as V-Bucks and Roblox as convertible to fiat and required people to declare these assets while filing tax returns. However, the IRS rolled back these rules on in-game currencies and chose to focus on virtual currencies that were generated cryptographically like Bitcoin and Ethereum. But this episode led to a larger question about in-game currencies considering the sheer volume at which they are traded. Some experts were of the opinion that any significant accretion of value, even through in-game currencies, will trigger a taxable event.

The explicit inclusion of NFTs in the Finance Bill’s definition of digital assets will muddy the waters of online game companies’ new revenue streams. Major publishers like Electronic Arts (EA), Ubisoft and Square Enix have started to issue NFTs as collectibles for hardcore fans of their games (much to chagrin of a significant number of gamers). This can bleed into other parts of the Internet as well as technology companies like Facebook and Twitter are exploring ways to incorporate NFTs as a monetisation feature for their creator economies respectively.

Some crystal-ball gazing

Loot boxes are a contentious topic and being debated widely in different parts of the world. Most loot boxes are purchased using in-game currency. India currently does not have any regulation on loot boxes but the expansion of a digital asset definition to include all in-game currencies and imposing a 30% might be overkill at this point. Right now, it might not have particular relevance on the value it creates outside the game’s ecosystem. However, it is worth considering statements made by Square Enix president Yosuke Matsuda:

“I realize that some people who “play to have fun” and who currently form the majority of players have voiced their reservations toward these new trends, and understandably so. However, I believe that there will be a certain number of people whose motivation is to “play to contribute,” by which I mean to help make the game more exciting. Traditional gaming has offered no explicit incentive to this latter group of people, who were motivated strictly by such inconsistent personal feelings as goodwill and volunteer spirit.”

Matsuda related this in the context of blockchain gaming where some players will be rewarded tokens and sees them as an extension of the user generated content economy where they “play to earn”.

This model isn’t a far-fetched idea pulled out of an episode of Black Mirror but current reality. Axie Infinity is a video game developed by Vietnamese studio Sky Mavis which has an in-game economy using NFTs. The object of the game is to collect, breed, raise, battle, and trade creatures. Players are also allowed to buy virtual “plots of land” and other in-game items as NFTs. As the player continues, they earn NFTs and are allowed to cash out every fourteen days. The game grew popular in the Philippines during the pandemic as sources of income dried up. The Philippines Department of Finance declared that income earned by this game is taxable though it is unclear if these NFTs are considered securities or currency.

Therefore, how in-game currencies are treated by regulation will ultimately decide the course of the video game industry. Concerted regulations around the world on loot-boxes and taxes on in-game currencies might deter video game companies from implementing these monetisation techniques and see games-as-service models unviable for them.

Author Credits: Shashidhar KJ, Consultant with inputs from Nehaa Chaudhari, Partner and Anirudh Rastogi, Managing Partner, respectively, at Ikigai Law