In this blog post, we take a look at the key highlights from the Union Budget 2022-23, as tabled by the Union Finance Minister in the Parliament of India on 01 February 2022.

On 1 February, Indian Finance Minister Nirmala Sitharaman (FM) announced the Union Budget (Budget) for FY 2022-23 and described its key takeaways in her Budget Speech.

The FM identified artificial intelligence, geospatial systems, drones, semi-conductor, space economy, green energy and clean mobility systems as sunrise sectors.[1] She noted that these sunrise sectors have immense potential to provide employment opportunities and make the Indian industry more sustainable, efficient and competitive. Consequently, the FM prescribed enabling policies, light touch regulation and facilitative actions such as building domestic capacity and promoting research and development to support these sectors.[2]

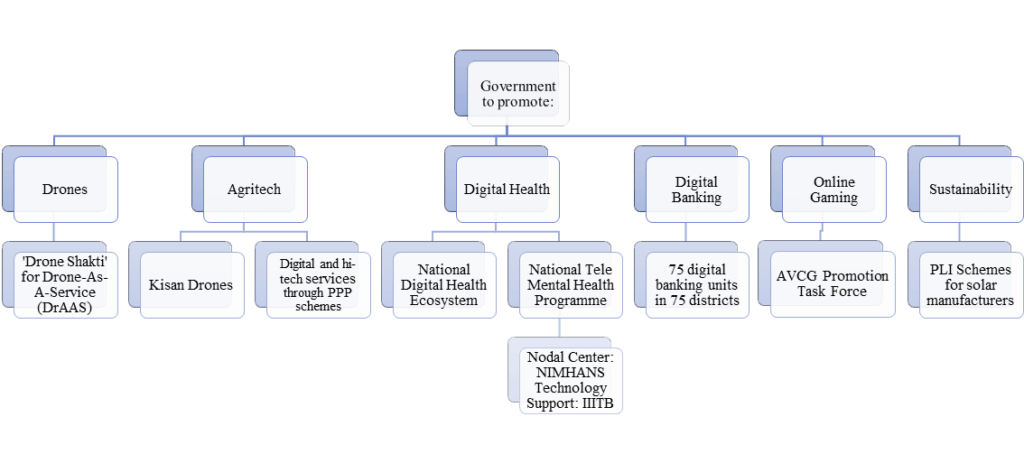

Technology, ease of doing business, sustainability, and boosting the start-up and MSME sectors form the mainstays of this Budget. The Budget also outlined the government’s intention to promote emerging technology sectors like online gaming; and technology interventions in traditional sectors like agriculture, health, and banking.

In this blogpost, we discuss key announcements from the Budget related to digital banking, digital infrastructure, ease of doing business, digitisation, telecom, and sustainability.

The graphic below shares a snapshot of some of emerging technology sectors that the government is looking to promote.

Source: Ikigai Law

Key highlights from Budget 2022:

1. Central bank digital currency and Virtual Digital Assets (VDAs)

The FM made significant cryptocurrency related announcements – including an update on the ‘central bank digital currency’ and on VDAs as defined in the Finance Bill, 2022.[3] Per the Budget, in 2022-23 the Reserve Bank of India will release the ‘digital rupee’ or ‘central bank digital currency’, built on blockchain technology. This is expected to make the currency management system efficient and cost-effective.[4]

The Budget introduced a scheme to tax VDAs including cryptocurrencies, non-fungible tokens, information/code generated through cryptographic means, and any other digital assets identified by the government. It proposed a 30% tax on income earned from the transfer of VDAs, and a 1% tax deducted at source on payments. Recipients of gifts of VDAs will also be taxed.[5] It also clarified that losses from the transfer of VDAs cannot be offset against other incomes.

Previously too, the government had expressed its concerns on the use of cryptocurrencies for money-laundering activities.[6] And so, the tax on VDAs is not entirely unexpected. The definition of VDAs is particularly significant as it is a step towards developing further regulations. Presently, the government is working on legislation to lay down the regulatory framework for cryptocurrencies.

2. Telecom

There were notable announcements for the telecom sector. The Budget announced that spectrum auctions will take place in 2022 to facilitate the rollout of 5G mobile services within 2022-23.[7] Separately, the Economic Survey (2021-22) noted that telecom sector reforms will boost 4G proliferation, infuse liquidity and create an enabling environment for investment into 5G networks. Additionally, a scheme for design-led manufacturing will be launched to build a strong ecosystem for 5G as part of the Production Linked Incentive (PLI) Scheme.

Under the Universal Obligation Fund, 5% of annual collections will be allocated to enable affordable broadband and mobile service proliferation in rural and remote areas. This is also expected to promote R&D and commercialization of technologies and solutions.[8]

The Budget also discussed the need to enable equitable access to e-services, communication facilities, and digital resources for residents in urban and rural areas. To this end, contracts for laying optical fibre in all villages, including remote areas, will be awarded under the Bharatnet project through public-private partnerships (PPP) in 2022-23. The project is expected to be completed in 2025.[9]

3. Connectivity and transport infrastructure

The FM discussed the PM Gati Shakti master plan (PMGS), which is a digital platform for tracking infrastructure projects. It brings together 16 ministries (including railways, civil aviation, electronics and information technology, textiles, among others) for coordinated planning and implementation of infrastructure connectivity projects.[10]

a. PMGS will comprise of 7 engines, one of which will be logistics infrastructure, supported by complementary roles of energy, IT communication, bulk water and sewage and social infrastructure. The logistics infrastructure engine will be powered by clean energy.[11]

b. Projects in the National Infrastructure Pipeline (a whole-of-government exercise to provide world-class infrastructure facilities) will be aligned with the PMGS to enable logistical synergy across modes and accelerate development.[12]

c. A unified logistics interface platform to allow efficient movement of goods across modes reducing logistical constraints, enabling inventory management and eliminating documentation will be created. This will be an open-source platform along international standards which will provide real time information to all stakeholders and give them greater visibility.[13]

d. Multi-modal logistics projects led by PPP will be launched in 2022-23.[14]

e. In the context of developing efficient logistics through railways, the concept ‘One Station-One Product’[15] was promoted to help local businesses & supply chains.[16]

Industry players believe that these initiatives along with an impetus to PMGS are likely to strengthen the consumer sector supply chain.[17] This is also in-line with the government’s vision to build world class logistics and infrastructure facilities in the country.

4. Micro Small Medium Enterprises (MSMEs)

The FM announced several initiatives to boost the MSME sector including an increase of over INR 6,000 crores in its budgetary allocation for the year.[18]

a. The ‘Emergency Credit Line Scheme’ (ECLGS) which provides credit to MSMEs in the hospitality sector, among others, has been extended till March 2023. The guarantee cover under this scheme will be expanded by INR 50,000 crore, bringing the total scheme value to INR 5 lakh crores.[19]

b. The ‘Credit Guarantee Trust for Micro and Small Enterprises’ (CGTMSE) scheme which provides collateral free credit to MSME players, was proposed to be revamped with the infusion of additional credit of 2 lakh crores. This is expected to generate employment opportunities in the sector.[20]

c. The ‘Raising and Accelerating MSME Performance’ (RAMP) programme (aims to mobilize formal financing and boost competition in the sector) will be rolled out, allocating 6,000 crores over 5 years.[21]

d. Prioritising the facilitation of ease of doing business, the Budget noted that 25,000 compliances have been reduced and nearly 1486 union laws have been repealed. The FM reiterated the government’s commitment to ‘minimum government and maximum governance’ and proposed digitization of manual processes, a single point access for all citizen-centric services, and standardization and removal of overlapping compliances.[22]

5. Electric vehicles (EVs) and clean mobility

The Budget placed emphasis on promoting public transport through clean and sustainable technology, special mobility zones, zero fossil fuels policy and EVs.[23]

Acknowledging that setting up charging stations in space-constrained urban areas will be a challenge, it proposed a ‘Battery Swapping Policy.’ This will set out interoperable standards for the EV ecosystem – meaning that EVs will be compatible with batteries made by different manufacturers. This is expected to enable EV users to easily and swap their discharged batteries for fully charged ones.

The FM also encouraged the private sector to develop sustainable and innovative business models for ‘Battery and Energy as a Service’.[24] This is in line with policy initiatives introduced by state governments (like Delhi, Maharashtra etc.) to accelerate EV adoption.

6. Data centres

To promote digital economy, fintech and technology enabled development, the Budget introduced measures to improve digital infrastructure in the country.

Data centres and energy storage systems (including dense charging infrastructure and grid scale systems) will be added to the harmonized list of infrastructure sectors, per the FM. An infrastructure status accorded to these industries will facilitate credit availability for digital infrastructure and clean energy storage.[25]

The government had announced its intention to grant infrastructure status to data centres in the Draft Data Centre Policy, 2020. The data centre industry is expected to be accorded infrastructure status from 1 April 2022 onwards. After which, the industry will be entitled to financial benefits, concessional rates for funding, and reduced costs of setting up. This development along with the government move to de-license electricity distribution last year, and breaking the monopoly of existing distribution companies, is likely to allow greater flexibility in power procurement.

7. Digital health

Per the FM, the government will roll out an open platform for the National Digital Health Ecosystem consisting of digital registries of health providers and health facilities, unique health identity, consent framework, and universal access to health facilities.[26]

Acknowledging that the pandemic increased and exacerbated mental health problems in the country, a ‘National Tele Mental Health Programme’ will be launched to provide better access to quality mental health counselling and care services.[27] A network of 23 tele-mental health centres of excellence will be established, with NIMHANS being the nodal centre and International Institute of Information Technology-Bangalore (IIITB) providing technology support.[28]

8. Drones

Identified as a sunrise sector, the Budget promoted the multi-sectoral adoption of drones led by start-ups. Start-ups will be promoted to facilitate ‘Drone Shakti’ through varied applications and Drone-As-A-Service (DrAAS).[29] To match increasing demand, select ITIs in various states will offer the required courses to train individuals. In her speech, the FM proposed the use of ‘Kisan Drones’ to aid farmers in crop assessment, insecticide spraying, among other things.[30]

Last year, the government notified the Drone Rules, 2021 and shared an airspace map to regulate the movement of drones in the Indian airspace. Given the Budget’s push to improve connectivity, use cases of ‘Drone Shakti’ may be in healthcare delivery, air taxis, and survey and mapping services. This move is in line with the government’s approach to the drones’ industry, an aspect that we have chronicled here.

9. Incentives for start-ups

The Budget extended the tax incentives to include startups established on or before 31st March 2023. Under this scheme, start-ups are eligible for incentives for up to three consecutive years out of ten years from the day of incorporation.[31]

Further, the FM announced that the government will set up an expert committee to address the regulatory issues that private equity investors and venture capitalists face when investing in the startup ecosystem. The committee will recommend measures to scale up investments while solving the frictions preventing such scaling up[32]

10. Electronics manufacturing

In line with the tech focus of the Budget, FM emphasised the importance of facilitating and promoting the domestic manufacturing of wearable devices, hearable devices and electronic smart meters. Duty concessions will be offered to transformers, mobile phone chargers and camera lens of camera modules. This will enable domestic manufacturing of high growth electronic items.[33]

11. Online gaming

The Budget noted the potential of the animation, visual effects, gaming and comic (AVGC) sector to employ young Indians. To facilitate the growth of this sector, it will set up a task force for the promotion of the AVGC sector. It has invited recommendations from all stakeholders on how to build capacity to better serve the Indian market as well as global demand.

Last month, Karnataka became the first state in the country to set up an AVGC Centre of Excellence[34] and the Union Government is also collaborating with IIT Bombay to set up a National Centre of Excellence in AVGC.[35]

This post has been authored by Tanea

Bandyopadhyay and Aparna Sridharan, with inputs from Vijayant Singh.

[1] Para 89, Union Budget Speech (February 01, 2022) at p. 15 (available at: https://www.indiabudget.gov.in/)

[2] Para 90, Union Budget Speech (February 01, 2022) at p. 16 (available at: https://www.indiabudget.gov.in/)

[3] (47A)

“virtual digital asset” means–– (a) any information or code or number or token

(not being Indian currency or foreign currency), generated through

cryptographic means or otherwise, by whatever name called, providing a digital

representation of value exchanged with or without consideration, with the

promise or representation of having inherent value, or functions as a store of

value or a unit of account including its use in any financial transaction or

investment, but not limited to investment scheme; and can be transferred,

stored or traded electronically; (b) a non-fungible token or any other token of

similar nature, by whatever name called; (c) any other digital asset, as the

Central Government may, by notification in the Official Gazette specify:

https://www.indiabudget.gov.in/doc/Finance_Bill.pdf

[4] Para 111, Union Budget Speech (February 01, 2022) at p. 19 (available at: https://www.indiabudget.gov.in/)

[5] Para 131 Union Budget Speech (February 01, 2022) at p.23-24 (available at: https://www.indiabudget.gov.in/)

[6] https://economictimes.indiatimes.com/news/economy/policy/pm-chairs-meet-on-cryptocurrency-concerns-raised-over-money-laundering-terror-financing-risks/articleshow/87688742.cms

[7] Para 82, Union Budget Speech (February 01, 2022) at p. 14 (available at: https://www.indiabudget.gov.in/)

[8] Para 84, Union Budget Speech (February 01, 2022) at p. 15 (available at: https://www.indiabudget.gov.in/)

[9] Para 85, Union Budget Speech (February 01, 2022) at p. 15 (available at: https://www.indiabudget.gov.in/)

[10] https://www.india.gov.in/spotlight/pm-gati-shakti-national-master-plan-multi-modal-connectivity

[11] Para 15, Union Budget Speech (February 01, 2022) at p. 3 (available at: https://www.indiabudget.gov.in/)

[12] Indian govt’s initiative announced in the last budget session. It seeks to provide world-class infrastructure to citizens and improve their quality of life. It also aims to improve project preparation and attract investments into infrastructure.

[13] Para 19, Union Budget Speech (February 01, 2022) at p. 4 (available at: https://www.indiabudget.gov.in/)

[14] Para 20, Union Budget Speech (February 01, 2022) at p. 4 (available at: https://www.indiabudget.gov.in/)

[15] This was envisaged to promote supply chain of local product using the railways and making each railway station a promotional hub and showcase destination for a local product.

[16] Para 22, Union Budget Speech (February 01, 2022) at p. 4 (available at: https://www.indiabudget.gov.in/)

[17] https://www.livemint.com/budget/how-budget-2022-proposals-will-affect-various-sectors-11643738743372.html

[18] https://msme.gov.in/sites/default/files/Impact-of-Budget-2021-22-on-MSME-Sector.pdf,

See also: https://economictimes.indiatimes.com/small-biz/sme-sector/budget-2022-23-budgetary-allocation-rises-for-msmes-but-some-key-schemes-see-a-cut/articleshow/89276388.cms

[19] Para 40, Union Budget Speech (February 01, 2022) at p. 7 (available at: https://www.indiabudget.gov.in/)

[20] Para 41, Union Budget Speech (February 01, 2022) at p. 7 (available at: https://www.indiabudget.gov.in/)

[21] Para 42, Union Budget Speech (February 01, 2022) at p. 7 (available at: https://www.indiabudget.gov.in/)

[22] Para 63 and 65, Union Budget Speech (February 01, 2022) at p. 11-12 (available at: https://www.indiabudget.gov.in/)

Para 72, Union Budget Speech (February 01, 2022) at p. 13 (available at: https://www.indiabudget.gov.in/)

[24] Para 73, Union Budget Speech (February 01, 2022) at p. 13 (available at: https://www.indiabudget.gov.in/)

[25] Para 107, Union Budget Speech (February 01, 2022) at p. 18 (available at: https://www.indiabudget.gov.in/)

[26] Para 51, Union Budget Speech (February 01, 2022) at p. 9 (available at: https://www.indiabudget.gov.in/)

[27] Para 52, Union Budget Speech (February 01, 2022) at p. 9 (available at: https://www.indiabudget.gov.in/)

[28] Para 52, Union Budget Speech (February 01, 2022) at p. 9 (available at: https://www.indiabudget.gov.in/)

[29] Para 45, Union Budget Speech (February 01, 2022) at p. 8 (available at: https://www.indiabudget.gov.in/)

[30] Para 33, Union Budget Speech (February 01, 2022) at p. 8 (available at: https://www.indiabudget.gov.in/)

[31] Para 129, Union Budget Speech (February 01, 2022) at p. 23 (available at: https://www.indiabudget.gov.in/)

[33] Para 149, Union Budget Speech (February 01, 2022) at p. 28 (available at: https://www.indiabudget.gov.in/)

[34] https://economictimes.indiatimes.com/news/india/karnataka-launches-countrys-biggest-avgc-center-of-excellence-in-bengaluru/articleshow/89022324.cms?from=mdr

[35] https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1762119